The sudden popularity of ChatGPT late last year brought Microsoft into the limelight. It was a key backer of the chatbot's developer, OpenAI, making an investment reportedly worth $10 billion.

Since then, Microsoft has been focused on integrating OpenAI's artificial intelligence (AI) algorithms across its product portfolio. This move seems to be bearing fruit for the tech giant. The market has rewarded Microsoft's AI efforts as well, as evidenced by the stock's 35% gains in 2023.

But Microsoft is not the only attractively valued AI stock you can buy right now. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Advanced Micro Devices (NASDAQ: AMD) are two alternatives that investors can consider buying that might also benefit from the proliferation of AI. Let's see why.

1. Alphabet

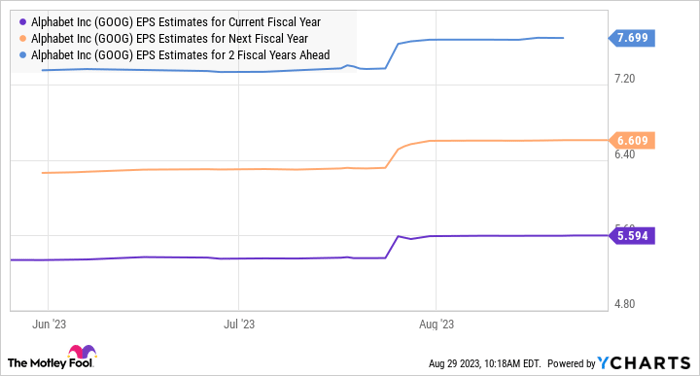

Shares of Alphabet have jumped 47% in 2023. Yet, the stock still trades at 27 times trailing earnings, and its forward earnings multiple of 22 points toward a solid improvement in the bottom line. A closer look at the following chart makes it clear that Alphabet is on track to deliver healthy earnings growth for the next couple of years.

GOOG EPS Estimates for Current Fiscal Year data by YCharts

What's more, analysts are expecting Alphabet to clock 16% annual earnings growth for the next five years. But don't be surprised to see the company outpace analysts' expectations thanks to AI, which it is deploying across multiple products, including its search engine, workplace collaboration, ads, and cloud computing.

For instance, the company's Google Cloud platform allows Alphabet's customers to train generative AI models. The tech giant pointed out on its July earnings conference call that "more than 70% of gen AI unicorns are Google Cloud customers." Alphabet says it provides customers with a wide range of supercomputers to train their models at aggressive prices.

Customers have access to over 80 AI models, which explains why the adoption of the company's cloud platform has increased thanks to AI. Alphabet CEO Sundar Pichai says that there has been a 15-fold jump in the number of customers using its AI offerings in the cloud. Not surprisingly, Alphabet's cloud revenue jumped an impressive 28% year over year in the second quarter of 2023 to $8 billion.

Mordor Intelligence forecasts that the size of the cloud AI market could grow at an annual pace of 32% through 2028, generating an annual revenue of $207 billion at the end of the forecast period. So Alphabet's cloud business could keep growing nicely in the long run thanks to the growing adoption of AI.

However, the cloud isn't the only area where the company could win from this technology. Alphabet is integrating its generative AI algorithm with multiple services, including Google Workspace, search, and digital advertising. In all, Alphabet is on track to take advantage of AI in multiple areas, which is why investors should consider buying the stock while it remains cheap.

2. Advanced Micro Devices

AI may not have given AMD as big a boost as its peer Nvidia, but that could change in the coming year. AMD's AI efforts have started gaining traction among customers, with CEO Lisa Su pointing out on the latest earnings conference call that the company had witnessed a seven-fold sequential increase in engagement with AI-focused customers. She added that these customers have begun programs where AMD's MI250 and MI300 data center accelerators are going to be deployed at scale in the future.

Not surprisingly, the chipmaker has started placing orders for more chips from its foundry partners. Taiwan Semiconductor Manufacturing, popularly known as TSMC, is reportedly adding more advanced wafer packaging capacity that will help it make AI chips to cater to the increasing demand from AMD. According to Taiwan-based media outlet DigiTimes, AMD could corner a third of TSMC's advanced chip supply by next year. That would be a huge deal for AMD, as Nvidia reportedly controls over 90% of the AI chip market at present.

It is also worth noting that AMD has reportedly struck a deal with Samsung for high-bandwidth memory (HBM) and advanced packing technology to manufacture MI300X AI accelerators, a chip that's expected to give Nvidia a run for its money. As such, it wouldn't be surprising to see a sharp acceleration in AMD's business from next year.

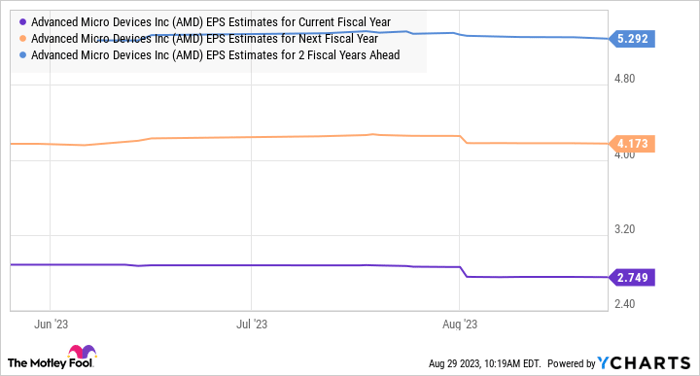

AMD EPS Estimates for Current Fiscal Year data by YCharts

Investors, however, could see AMD growing at an even faster pace, as there is raging demand for AI chips. Allied Market Research estimates that the AI chip market could clock annual growth of 37% through 2031 and generate annual revenue of $263 billion at the end of the forecast period.

Nvidia's first-mover's advantage in this niche has supercharged the company's growth, allowing it to double its revenue in the second quarter of fiscal 2024 (for the quarter ended July 30) to $13.5 billion. It expects stronger year-over-year revenue growth of 171% in the current quarter to $16 billion. AMD may be able to replicate such impressive growth, as there is space for more than one chipmaker in the multibillion-dollar market for AI chips.

All this indicates why investors should consider buying AMD. It is trading at 7.5 times sales, a nice discount to Microsoft's multiple of 11.4, but it may not be available at this relatively cheap valuation in the future given the massive end-market opportunity AMD is sitting on.

10 stocks we like better than Alphabet

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Alphabet wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of August 28, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

0 Comments