Shutthiphong Chandaeng

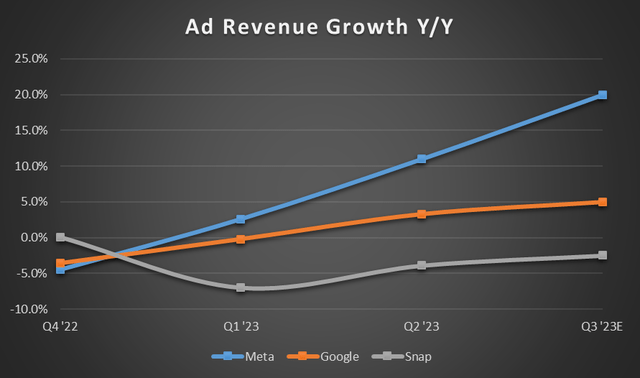

The rebound in the advertising industry has been moderately tepid; growth hasn't been more suggestive than a bottom being in place. Single-digit revenue growth has been the norm among the larger digital advertisers like Meta Platforms (NASDAQ:META), Alphabet (GOOG)(GOOGL), and Snap (SNAP) over the last few quarters. But, recently, there's been a breakaway in the pack. Meta Platforms has pulled ahead in the ad rebound, thanks to its efforts in AI, both on the user and advertiser sides. This has been reflected in its outperformance in Q2 and guidance for Q3, where it expects to push back into the 20% revenue growth range - before any bonus of exceeding guidance. This clear bifurcation has led me to a strengthening of my bullish thesis for Meta and a weakening of my thesis for Google and Snap.

Well, It's Just Because Of Last Year...

I'll start with some of the obvious talking points. For example, it's easy to say Meta's revenue growth is returning because it's lapping the hardest-hit quarters or because foreign exchange is no longer a headwind. However, the company's guide for Q3 is within range of exceeding the all-time quarterly revenue record of $33.67B (a Q4 number that had seasonal help). And while 2022's Q3 was the bottom of the revenue growth decline, coming back into record territory within a year is not a window-dressed accounting engineering tactic or the result of time and mere lapping.

Furthermore, this strengthening of its ad business is accelerating much faster than its peers. Google has had very tepid growth these last few quarters, and Snap remains in the hole with negative growth in the previous two quarters and the same expected for the upcoming quarter.

But none of this surprises me.

I've been analyzing Meta's actions related to AI and how its investments in AI are the differentiators. As early as June 2022, I was outlining Meta's investments in AI and how it would directly impact its recommendation feature, leading to ad targeting improvements. Investors and analysts have been so focused on the metaverse when it comes to the elevated CapEx and the main talking points. However, the company has focused very intentionally on using its AI solutions to directly improve its main business more than the rest of the AI investment case.

Getting to the numbers, the pick-up is pretty staggering for Meta compared to its peers.

| Revenue Growth % | Q4 '22 | Q1 '23 | Q2 '23 | Q3 '23E |

| Meta | -4.5% | 2.6% | 11.0% | 20.0% |

| Google (Ad Business) | -3.6% | -0.2% | 3.3% | ~5.0% |

| Snap | 0.1% | -7.0% | -3.9% | -2.5% |

(Source: Each company's official earnings releases; Google Q3 '23, my estimate)

And, as I said, Meta is lapping its weakest quarter from 2022, as Q3 '22 had the weakest revenue growth rate and the lowest absolute dollar amount recorded in that time.

Meta Platforms' Earnings History (Seeking Alpha)

And before you say its peers are different, Google is still getting into its worst-performing quarter in 2022, meaning its revenue growth rate lapping should be shifting to better 2023 performance. Yet, its growth rate remains in the single digits for its ad business with very little sequential acceleration.

Management's non-specific guidance of incremental improvement for advertising over the halved sequential year-over-year period from 2022 doesn't spell out an exciting Q3.

Google's Earnings History (Seeking Alpha)

Snap is in the worst position as it remains in negative growth as it laps 2022's declining growth.

Snap's Earnings History (Seeking Alpha)

With guidance for -2.5% growth for FQ3, there needs to be an improvement once it laps the near-zero growth FQ4 of '22. Otherwise, the company is genuinely declining and won't be able to show improvements until it laps its 2023 weakness in 2024.

Now, you might be saying, "Meta is "ahead" in its lapping of weakness because 2022's peak weakness was Q3, not Q4 like the others," and you'd be correct - sort of. After all, Meta's Q4 has the exact same peak weak growth rate as Q3. But my point is the acceleration at which Meta is seeing growth return, and visualizing it may help to understand what I'm describing.

Chart mine, data from Earnings Press Releases

Notice how Meta started gapping its peers this past quarter. And with guidance of 20% growth for Q3, it continues to show linear acceleration while its peers already show a slowing in the rate of acceleration.

Why is this? Short answer: differing AI strategies.

AI Is The Difference In Results

The conventional wisdom says Meta's targeting is better, and Google's is more of the "go-to" just-put-money-here place. But in 2023, this is more than just better targeting. It's surfacing ads with relevancy based on data points beyond the traditional what-the-user-gives-you type of information. With AI, it's based on usage patterns and things users didn't "say" they were interested in but were suggested through multiple other "predictive" data points. Much of this latter point comes from Meta's new AI-driven recommendation feature.

But beyond this user-sided set of AI features for advertisers is the predictive model for how an ad will perform before a marketer pays for it.

Almost all our advertisers are using at least one of our AI driven products. We've also deployed Meta Lattice, a new model architecture that learns to predict an ads performance across a variety of datasets and optimization goals.

- Mark Zuckerberg, CEO, Meta's Q2 '23 Earnings Call

This kind of AI product set is driving Meta's market share gains and differentiates it from its competitors. Contrast this strategy with Google and its ad products driven by AI.

It's worth reiterating that while generative AI is now supercharging new and existing ads products with tons of potential ahead, AI has been at the core of our ads business for years. In fact, today, nearly 80% of advertisers already use at least one AI-powered search ads product.

- Philipp Schindler, CBO, Alphabet's Q2 '23 Earnings Call

Notice the difference. AI has been "at the core" of the company's business for years. So, where's the incremental value add, and why isn't it showing up on the revenue line? Moreover, 80% of Google's advertisers are using at least one AI ad product to Meta's (nearly) all. And that's with Google having a supposed much longer head start.

But it gets a bit more detailed and unfavorable for Google.

Advertisers tell us they're looking for more assistive experience to get set up with us faster. So at GML, we launched a new conversational experience in Google Ads powered by a LLM tuned specifically from ads data to make campaign construction easier than ever. Advertisers also tell us they want help creating high-quality ads that work in an instant. So, we're rolling out a revamped asset creation flow in Performance Max that helps customers adapt and scale their most successful creative concepts in a few clicks.

- Philipp Schindler, CBO, Alphabet's Q2 '23 Earnings Call

Both companies know advertisers want help, but notice the difference in attitude with each company toward approaching advertisers. Meta says, here's a tool to get you a better ad creative; use it to generate an advertisement you like, and we'll give you a good idea of how it'll perform. But Google says we have a hammer (LLM-style input), and everything is a nail (our advertisers using a creative tool like a search product). Advertisers aren't attracted to creating something using natural language - it leaves too much open-endedness - and there's a lot lost in what a marketer doesn't "say" in their prompt. Meta is saying, here, we'll generate something, and you tweak it from there based on what is working right now in the field.

How do I know advertisers don't like it? The revenue growth is the truth, and the truth is Meta is seeing success, and Google is seeing a blasé exit of this down part of the ad cycle.

The bottom line is Google approaches its advertisers like its users, whereas Meta approaches both sides of its house differently but with the same core idea. And on top of that, Google is saying it's been using AI for years, so it's just upping its tech a bit. Well, there's not a whole lot of new there and the new that is there is treating advertisers like users when they are two very different use cases.

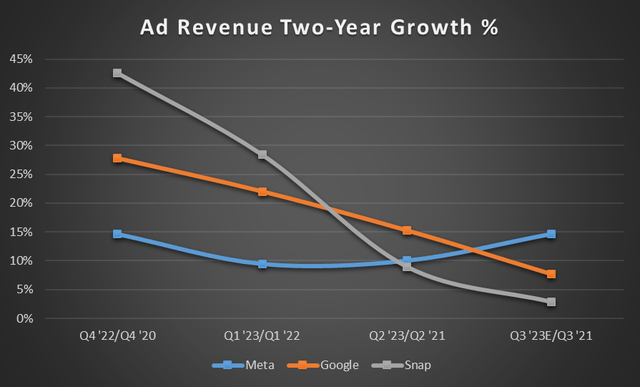

My point is Meta is being very intentional and precise in its use of AI for its users and marketers, and it's proving to be the right path based on returning to 2021 growth rates - rates last seen during the pandemic surge.

It's Apparent Across The Board

Speaking of 2021 growth rates, the below chart reinforces Meta is already exiting this ad cycle with accelerating growth rates over the pandemic ad surge period.

Chart mine, data from Earnings Press Releases

While both Google and Snap are maintaining a downward trajectory into Q3, Meta is already setting its sights on a continued ramp into the end of the year. There's a clear and distinct difference between these three companies and the online advertising business. Two of them are dealing with little to no AI in their ad business or a strategically wrong approach, while one has been investing for well over a year with productive results, both internally and in the financial reporting.

A Lot Of Potential Brings Risk, But Valuation Keeps Them Minimal

Meta must continue to perform if it's going to have a shot at keeping its head above water. It was only last year when a cyclical decline in online advertising combined with continued iOS signal loss from Apple's (AAPL) OS privacy updates to push the company's top line into negative territory. It was a struggle for the company to make it through, and the stock took the full brunt of it into the double digits for the first time since 2016 - even the pandemic couldn't bring it down to those depths. So, just because its AI investments are working out in its favor in 2023 doesn't mean the company can relax and coast. This is the time it must lay on the investments in the areas that are working; otherwise, this may be a blip on the revenue growth radar.

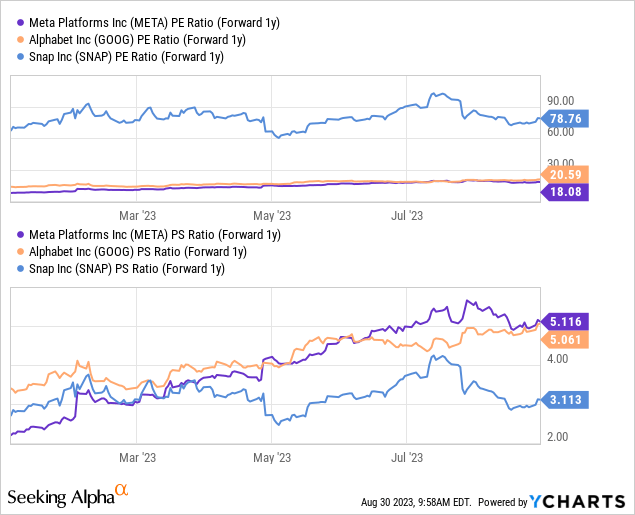

But, because the valuation is low historically and comparatively to its peers, there's not a high level of risk the stock will be hammered as it works through this bullish year and expectations fluctuate.

Compared to Google and Snap, Google is the only one worth comparing. Snap's wayward profitability puts its P/E ratio in a different zip code - even on a forward basis. But if you look at Meta's forward P/E, it's under Google's even as Meta has better growth expectations moving forward.

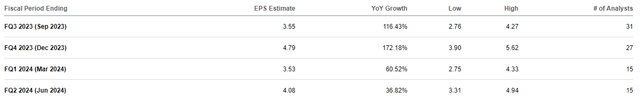

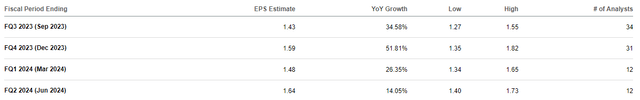

Meta's EPS Analyst Estimates (Seeking Alpha) Google's EPS Analyst Estimates (Seeking Alpha)

There's more than three times the growth in near-term EPS estimates for Meta over Google, yet Meta's valuation remains less than its competitor. This kind of risk-reward setup is currently hard to come by. Meta's AI investments paying off haven't quite sunk into the stock price - advantage to the investor with patience. With some outperformance in the next quarter or two, the stock should find another leg higher by the end of the year (likely after the next report). Until then, I expect some consolidation while investors grapple with how to value the return on investment for the company's AI endeavors.

Solidifying My Bullish Stance In Meta

There was a time not long ago when I expected Meta to flounder and was thinking of severely trimming my long position - it was around when the iOS changes went into effect and the ad cycle began to weaken. But once I saw Meta investing heavily into the business side of AI, I expected revenue growth to return. And in February, I called it out as the beginning of the shift.

The company plans to invest much of its CapEx toward AI, not just for the metaverse but for internal product enhancements and improvements. This is key to improving revenue growth.

We're now seeing the company reap the benefits, above and beyond its competitors and beyond what I expected for Q3 '23 back in Q1 of this year. I don't expect this to slow down, and I don't expect Google to find its way with its current AI strategy for its advertising business. Snap is a whole other story, and I plan on writing a separate article on my shift in thesis on it and why (because it's not just about AI and ads).

0 Comments