Last year, every marketer spending budget in Google Ads (formerly known as AdWords) held their breath at the beginning of October. Why?

That’s the day Google decided to drop what, upon first glance, appeared to be a bomb:

“Starting October 4, 2017, campaigns will be able to spend up to twice the average daily budget to help you reach your advertising goals.”

We took a deep dive into our MCC to see exactly how this change played out in Q4. Before we get to that, though, a quick refresher on exactly what changed…

What Changed with Your Google Ads Budget (Recap)

Simply put, Google made a big change to what they call “overdelivery.”

Overdelivery is a term that references Google’s ability to exceed your stated daily budget in an effort to put your ads in front of more eyeballs (and, you know, make a little extra bread). The policy has been in place for some time now, though earlier instances only allowed Google to exceed your daily budget by 20%.

The change, which sent many SEMs into a tizzy, allowed the search giant to exceed your budget by 100%, theoretically doubling your ad spend on a daily basis.

Now, this did not mean that Google was going to put you out of business by doubling your desired budget every day. At all.

It simply meant that, on days where traffic was high, you could see your costs increase up to 100% per campaign. This change, however, is counteracted on slower days, when ad spend can be substantially lower. Google’s goal is to get you to hit your “monthly charge limit,” which it defines as the average number of days in a month—30.4—multiplied by your average daily budget; that’s hit, not exceed.

Some people freaked out. We told you not to panic. Here’s what we’ve seen so far.

Our Findings

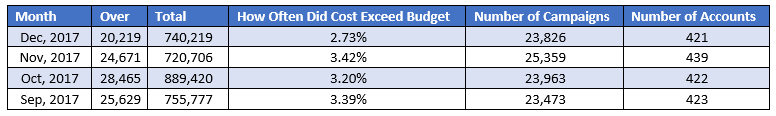

We noticed that in September (before the overdelivery change occurred), 3.39% of the campaigns in our MCC exceeded their daily budgets at least once over the course of the month. That’s our baseline.

Interestingly enough, after the change we actually saw fewer campaigns exceed their stated budgets on any given day:

- October – 3.20% of campaigns spent over budget at least once

- November – 3.42% of campaigns spent over budget at least once

- December – 2.73% of campaigns spent over budget at least once

Even if one of your campaigns happened to fall into the sliver that did exceed budget at some point in Q4 (our aggregate for the three-month period was a mere 3.12%), it could not have possibly done so with enough frequency that your advertising performance or bottom line was impacted.

Safe to say, at least as far as our clients go, that this change has had a limited impact. In fact, it’s proven to be less impactful than Google’s old overdelivery policy.

Observations from Other PPC Practitioners

Search Engine Land conducted a phenomenal roundup at the beginning of January, in which Ginny Marvin noted that the majority of the overdelivery problems reported occurred in new and/or automated campaigns. She also spoke with a number of SEMs about their experiences with Google’s shift in budget distribution.

Results varied.

Four of the consultants who provided feedback stated that they hadn’t seen many issues or had avoided them entirely by using budget monitoring Google Ads scripts. One noted that the change has brought a renewed focus to budget pacing (a time suck for small agencies), while another mentioned the impactful inconvenience the new overdelivery system places on complex ecommerce accounts.

Among the tales, one horror story was reported, in which a new campaign blew through a whole month’s budget in a single day! Thankfully, it quickly normalized.

In Conclusion

Crisis averted (for most of us, at least)!

In the event you’re in the minority of advertisers struggling with budget overdelivery issues, try using scripts to keep a firm grip on your budgets and bids.

(Shout out to Patrick Henry, marketing analyst extraordinaire, for his help in pulling and making sense of the data for this post.)

Data Sources

Data is based on a sample size of between 420 and 440 Google Ads accounts (WordStream clients) advertising on the Search Network between September and December of 2017. Only accounts advertising in the United States were included.

0 Comments