Do Google’s Shopping campaigns (the new version of Product Listing Ads) work? My answer 100 out of 100 times would be yes! The results speak for themselves, but simply, what advertiser wouldn’t want to see metrics and bid at the specific product level??? I’ve worked with accounts that have super-segmented product feeds and accounts that aren’t segmented at all. The results will vary account to account, industry to industry.

For me the biggest asset with Shopping ads is clarity. You can now see everything you need to manage a PLA campaign almost as if it were a regular search campaign. You can see which specific products are accumulating the most spend, you can see which products are converting and for how much. You have the power to manage PLAs like you do keywords (minus match types).

RELATED: Does Google AdWords Work?

RIP Product Listing Ads

Don’t want to make the migration to Shopping ads? Well unfortunately, Google is forcing everyone to to make the transition in late August of 2014. This post will help you make the transition and tell you why you should be excited.

Here’s an overview of the topics:

- Transitioning to Shopping Campaigns

- Custom Labels Optional

- Case Study – Before and After Product Feed Segmentation

- Case Study – Optimization and Progression

- Conclusion

Transitioning PLAs to New Shopping Campaigns

The task of transitioning from Product Listing Ads to Shopping campaigns can be a little nerve-racking, but have no fear. Here are a few guidelines to follow:

- Strategically choose how you want to segment your feed into Product Groups: Category, Brand, Item ID, Condition, Product Type, Custom Labels.

- Try to be consistent with any bids or labels you we’re using previously. If you’re segmenting your feed for the first time, start with a conservative default bid 15-30% less than your previous bid. This will ensure that you don’t get blindsided overnight. It’s always easier to raise bids, versus taking a hit and retroactively reducing bids based on poor results.

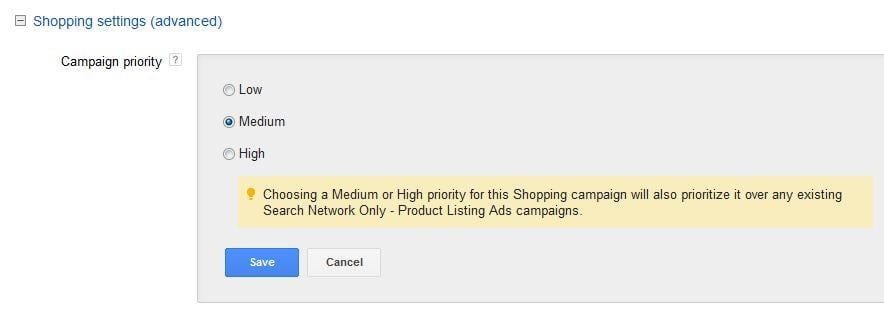

- I’ve heard mixed reviews; however, in my experience I choose to run my historical PLAs and new Shopping PLAs simultaneously. For days 1-3 I set the “Priority Level” to Low. For days 3-5 I set the “Priority Level” to Medium.

- Once your Shopping PLAs start accumulating more and more traffic, start adjusting bids within specific products groups.

- After you start applying different bids to different product groups, adjust the “Priority Level” to High or turn off your historical PLAs.

- Sit back and enjoy the improvement in ROI!

Custom Labels Optional

One of the biggest advantages of Shopping campaigns is you don’t have to create custom labels in your product feed to allow you to start bidding differently within AdWords. Shopping PLAs use the columns within your feed already, and give you the option to subdivide by:

- Category

- Brand

- Item ID

- Condition

- Product Type

- Up to 5 Custom Labels

Case Study 1 – Before and After Product Feed Segmentation

The first case study is an online candy retailer. This account started using Product Listing Ads in the later part of 2013. We set up the campaign, used the default “Ad Group #1” and applied one Max CPC bid across all products.

Within the first week couple weeks, we were already pleased with the results we generating. The PLAs continued to perform for us, so the daunting task of segmenting our feed never arose. When Shopping campaigns were released it allowed us to segment our PLAs without adding anything new to our product feed. The metrics below reflect the same date range and what happen after we started applying different bids to different categories, brands and products.

The metric that jumps off the page is the ROAS (return on ad spend), which increased by 174%!

How you might ask? I choose to segment my new Shopping campaign by Brands. The reason I choose to segment by Brands is because I know certain brands have higher margins and certain brands typically generate higher AOVs. Knowing that information, I translated that into my bidding system. I started applying different bids based on the Brands, and then as more and more data came back I just treated each specific product like a keyword, and bidded on them separately.

The beauty of Shopping campaigns is you can segment your feed without getting your hands dirty! Couple clicks and you’re all set – you never have to touch the feed in Merchant Center.

Case Study 2 – Optimization and Progression

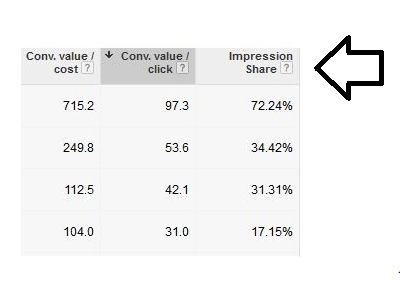

In this case study I want highlight the progression you can make, when you have data at your fingertips and the ability to manage around it. In this 8-week period, we experienced phenomenal improvement week over week.

Each week I was able to adjust my bids based on the results I was generating. Seeing the improvement, gave me the confidence to keep raising the budget, which explains the increase in conversion totals. The improvement in Value/Conv. and ROAS week over week I credit to bidding adjustments. I was able to be much more aggressive on products that continued to generate great return.

How did I know where I could push up on bids without bringing down ROAS?

The answer to that is the Search Impression Share column.

AdWords defines Impression Share as: “the impressions you’ve received divided by the estimated number of impressions you were eligible to receive.”

When I look at the picture above, those impression share percentages tell me I have the potential to show more frequently. I used that % to tell me where I can be more aggressive. If the product group was consistently generating a ROAS I was happy with and the search impression was low, I immediately knew I could squeeze even more out of those product groups.

Google has been kind enough to provide us with a few other metrics we can use to judge our performance against.

- Benchmark CTR – “The benchmark clickthrough rate (CTR) tells you how other advertisers’ Product Listing Ads for similar products are performing based on how often people who see their ad end up clicking on it.”

And….

- Benchmark Max CPC – “The benchmark maximum cost-per-click (max. CPC) tells you how other advertisers are bidding on similar products.”

I recommend focusing on Impression Share versus Benchmark CTR and Benchmark Max CPC. Sure those columns great, and I do look at them. But many of us don’t have the luxury of jacking our bids up to what Google deems as a “Benchmark CPC” just to see what happens.

Here’s a quick look at my results vs. Google’s “Benchmarks”:

Take that Google! Based on my continued bidding adjustments I was able to achieve average CPC’s 30-75% below what you claim as a “Benchmark.” (We can’t fault Google, it’s their business too after all.) I would recommend starting with a lower bid and increasing it based on the results you’re generating and amount of impression share you’re capturing.

In Conclusion…

TAKE ADVANTAGE OF SHOPPING CAMPAIGNS! You’ll have to eventually, but don’t wait!

0 Comments