Amex Credit Cards List 2023: Best American Express Credit Cards, Features, Eligibility, And Rewards. American Express is a multinational bank based in the US that serves to provide a variety of financial services. American Express is also known as Amex. This bank was established in 1850. The headquarters of this bank is located in New York City. The different types of financial services this bank provides include credit cards, charge cards, etc.

For people who travel more or prefer to shop more, American Express offers a wide range of credit cards. The American Express credit card comes with various privileges, discounts, and benefits. Through this credit card, customers can get a lot of offers on food, movies, shopping, lifestyle, etc. Customers can use the American Express credit card to increase their savings through the highest discounts and benefits. These credit cards come with many exciting rewards programs.

American Express credit cards are known for their excellent services. It can be easily used for international spending payments. So if you travel more internationally, there can be no better option for you than an American Express credit card.

Next, in this article, we will give you specific information about how to Apply For an American Express credit card. After reading this article in full, you will be able to easily get information about how to Apply for an American Express credit card. Also, we will try to give detailed information about the eligibility conditions and necessary documents required And how to Apply Online For an American Express credit card.

Amex Credit Cards List

American Express (Amex) is a well-known financial services corporation that offers a range of credit cards to individuals and businesses. Amex credit cards are known for their premium features, rewards programs, and excellent customer service. on This Page, we are providing you with All the important Information About the Credit Cards Of Amex.

| Card | Details |

| American Express® Gold Card | |

| Blue Cash Preferred® Card | |

| Blue Cash Everyday® Card |

|

Amex Credit Cards List: Amex Credit Cards Benefits

These are Some Of the benefits of Amex Credit Cards Which Customers Can Avail of. Check All Amex Cards Benefits.

- Financial Flexibility:

- Reward offers and benefits

- 24×7 Platinum Assist

- Online Facilities For Credit Card Users

- Contactless Payment Facility

- Zero Lost Card Facility

- Online Fraud Protection Guarantee

- Membership Rewards

- EMI Facility

- Fuel Payment Rewards

- Airport Lounge

1. Membership Rewards:

- Amex credit cards typically offer Membership Rewards, a loyalty program that allows cardholders to earn points on their purchases.

- These points can be redeemed for various rewards such as travel, merchandise, gift cards, or statement credits.

2. Annual Fees:

- Many Amex credit cards have an annual fee associated with them, which varies depending on the specific card and its benefits Which Customers avail.

- However, there are also no annual fee options available For Customers.

- Some Amex cards may have no annual fee or offer a waived fee for the first year.

3. Rewards and Benefits:

- Amex credit cards often provide benefits tailored to specific spending categories or lifestyles.

- For example, there are Amex cards focused on travel rewards, cash back, premium services, dining privileges, or business-related perks For Customers.

- These benefits can include airport lounge access, travel credits, concierge services, purchase protections, and more.

4. Global Acceptance:

- American Express is widely accepted worldwide, but it’s worth noting that there may be some establishments or regions where acceptance may be limited compared to Visa or Mastercard.

- However, the acceptance of Amex cards has significantly improved in recent years.

- Most countries Accept American Express Cards.

5. Customer Service:

- Amex is known for its exceptional customer service, offering 24/7 support And assistance to its cardholders.

- They often provide assistance with billing inquiries, account management, and dispute resolution.

6. Creditworthiness and Approval:

- Amex credit cards are generally targeted toward individuals with good to excellent credit scores.

- While specific requirements may vary based on the card, a solid credit history is usually preferred for approval.

7. Premium Services:

- Amex offers premium services to its cardholders All Over the World, including 24/7 customer service, purchase protection, extended warranty, and travel insurance.

8. Financial Tools:

- American Express provides online account management tools and mobile apps that allow cardholders to track their spending, set spending limits, and manage their rewards.

Note: It’s essential For Cardholders to note that specific details, benefits, and eligibility criteria can vary depending on the particular American Express credit card you are interested in. It’s advisable to review the Credit card terms and conditions, rewards structure, fees, and benefits of each card before applying to ensure it aligns with your financial needs and preferences.

American Express Credit Card List: Eligibility Criteria

When applying for an American Express Credit Card, the applicant must meet the following eligibility criteria.

- The age of the applicant should be more than 18 years.

- The annual income of the applicant should be Rs. 6 lacks or more.

- The applicant must have a savings or current account with an Indian or multinational bank in India.

- The applicant must be an Indian resident.

- The applicant must have a good credit score.

- Must not have been declared for bankruptcy in the last 7 years.

|

How to check eligibility to get an American Express Credit Card In the USA?

Find out now whether you qualify for a Credit Card Or Not. American Express pre-application form takes just 30 seconds to complete. Check Your eligibility for a Credit Card.

- Visit the Official Website of American Express @ https://www.americanexpress.com/en-in/

- First You Need to Enter three simple details: your full name, email address, and telephone number.

- Next, Read the terms to provide your consent and click ‘Verify & Check Eligibility’.

- Now Wait to be redirected and find out whether you are eligible.

- Now If your pre-qualification is approved By Bank, you will be redirected to the American Express Credit Cards Home page, where you can apply for a card of your choice.

- You may also be contacted by a member of our team to ask you a few more questions.

How To Apply For American Express Credit Card Online?

Follow The Details Process Given below. Follow Each Step to Apply For a Credit Card Online.

- First of all, you have to go to the official website of American Express.

- After this, you have to go to the American Express credit card page or charge card page.

- After this, you have to choose the credit card you want to apply for.

- Now, you will see the “Apply Now” button, on which you have to click.

- A separate window of the application form related to the card will open.

- In this application form, you have to fill in all the information sought. In this, your personal details such as name, date of birth, income, address, etc. have to be filled in correctly. After this, you have to save your page and go to the next page.

- Here you will be asked for financial information related to you, such as your bank details etc. You have to fill it out correctly, after which you can proceed.

After reviewing all the information filled you, you can submit your application form.

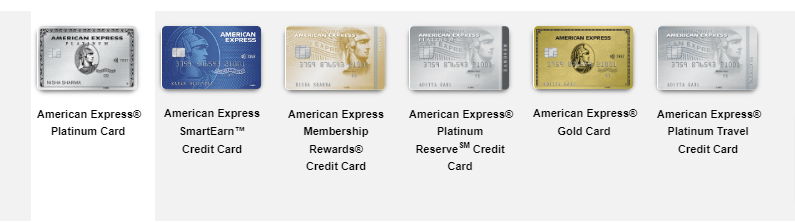

Amex Credit Cards List: Best Amex Credit Cards List In 2023

These are the Best American Express Credit Cards. Check the Name Of All Credit Cards.

- American Express Platinum Credit Card

- American Express Platinum Reserve Credit Card

- American Express Gold Credit Card

- American Express Platinum Travel Credit Card

- American Express Membership Rewards Credit Card

- American Express SmartEarn Credit Card

AmEx Credit Cards Reward Points and Cashback Benefits in 2023:

| Credit Card | Reward Points / Cashback |

| Amex Platinum Credit Card |

|

| Amex Gold Credit Card |

|

| Amex Platinum Reserve Credit Card |

|

| Amex Platinum Travel Credit Card |

|

| Amex Membership Rewards Credit Card |

|

| Amex SmartEarn Credit Card |

|

What Is the Annual Fee Of Amex Credit Cards?

Different Amex credit cards charge different annual fees, which can be more or less depending on the features and benefits of that particular card. Credit cards with low annual fees are generally targeted at low-income individuals or people who are new to the world of credit cards, and cards with high annual fees target high-net-worth individuals who have good prior experience using credit cards:

| Credit Card | Joining Fee | Renewal Fee |

| American Express Platinum Credit Card | Rs. 60,000 | Rs. 60,000 |

| American Express Gold Credit Card | Rs. 1,000 | Rs. 4,500 |

| American Express Platinum Reserve Credit Card | Rs. 5,000 | Rs. 10,000 |

| American Express Platinum Travel Credit Card | Rs. 3,500 | Rs. 5,000 |

| American Express Membership Rewards Credit Card | Rs. 1,000 | Rs. 4,500 |

| American Express SmartEarn Credit Card | Rs, 495 | Rs. 495 |

Note: This Is the annual Fee For Indian Customers.

What Documents Required For Amex Credit Card?

In India, You need to submit KYC documents including ID proof (Aadhar Card, Voter Card, PAN Card, etc.), address proof (Aadhar Card, Voter Card, electricity/telephone bill, etc.). Also, you need proof of income like salary slips or audited ITR acknowledgement to the card issuer for your card application to be processed.

- Aadhar Card

- Voter Card

- PAN Card

FAQ: Amex Credit Cards List

What are so special Features of the Amex credit card?Ans: Amex permits the issuance of cards on the Amex network by other banks and credit unions. Rewards on the cards are common. |

Is it hard to qualify for an Amex card?Ans: For those with at least decent credit (700+), American Express approval probabilities are best. Additionally, cardholders must have a yearly income sufficient to cover the card’s annual fee (if there is one) and any applicable balance in full. Additionally crucial are having little debt and a stable job. |

What is Amex’s annual fee?Ans: Depending on the card, American Express yearly fees range from $0 to $695. In the event that an Amex credit card contains an annual fee, it is charged once upon account opening and once more each year in the month of the card’s anniversary. |

0 Comments