With the exception of Louis XVI and the guy who played drums for Nirvana before Dave Grohl, a little healthy competition never hurt anybody. In fact, when you’re vying for consumers’ loyalty in an increasingly competitive ecommerce landscape, competitive insights can make a huge difference.

Well, that’s why we’re here today. We surveyed 75 small and medium-sized ecommerce businesses that advertise on Google Shopping. These are the five most telling insights from that data—insights you can use to help you run your ecommerce business.

The big, broad takeaway: There’s plenty of room for you to automate the tedious stuff and use those time savings to both improve your campaigns and break into the marketplaces and platforms your competitors haven’t reached yet.

Download our free guide to Google Shopping and you’ll learn what it takes to build a killer ecommerce marketing campaign!

1. 67% of small ecommerce businesses name campaign structure as biggest challenge

50 of the 75 Google Shopping advertisers we surveyed said structuring their campaigns and organizing their product groups is the biggest challenge they face. Tangentially, the second-most common challenge cited by respondents was setting bids. Because campaign structure and bid strategy are related, we’ll tackle both here.

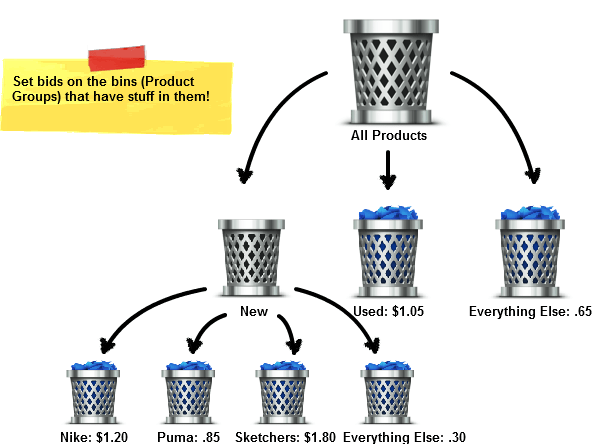

When you initially create a Google Shopping campaign, Google groups together all the products you sell (as outlined in your product data feed) in a single product group. From there, it’s your responsibility to break that initial product group into separate product groups. Because you’ll be setting bids at the product group level, this is a crucial part of the campaign creation process.

When creating your product groups, three metrics in particular are important to keep in mind: price, profit margin, and conversion rate. To the best of your ability, you want the products in a given group to be close to equal across (at least two of) these three metrics. If you include your most and least profitable products in the same group, the same bid will apply to all of them.

Remember: The bid you set on a product group is the amount of money you’re willing to pay for a click on any of the products included in that group. You shouldn’t be willing to pay the same amount of money for clicks on two drastically different products. Generally, you should set higher bids on products that are more expensive, more profitable, and higher converting.

If you can segment your product groups in a way that puts your budget to the most efficient use possible, you’ve have a leg up on the rest of the pack.

2. 40% of small ecommerce businesses manage data feeds manually

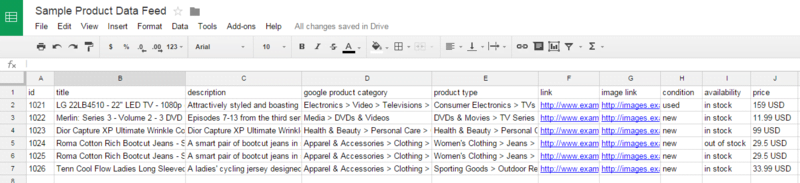

Another key challenge cited by the advertisers who completed our survey was managing a product data feed. As it turns out, 40% of respondents are doing this manually with Google Sheets or CSV files.

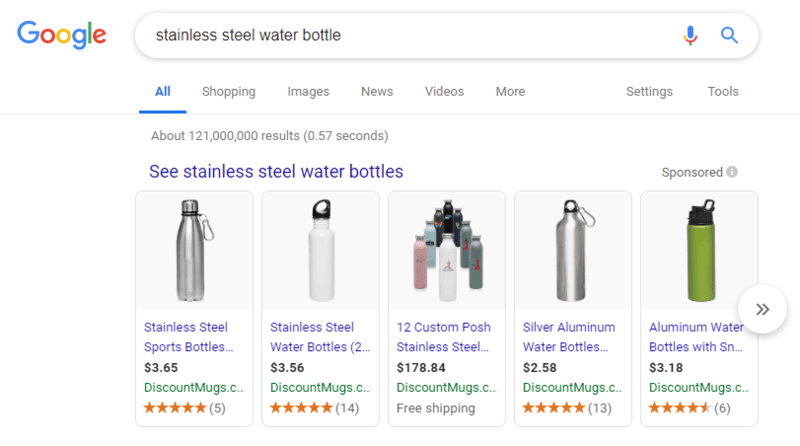

In case anyone reading hasn’t gotten started with Google Shopping yet, a product data feed is simply a spreadsheet (housed in Google Merchant Center) that organizes key information about your products in a manner that Google can easily understand.

This is the information Google relies on to populate the Shopping search results when a consumer searches for a product. So, the better you manage your product data feed, the better chance you have of getting your products in front of relevant, high-intent shoppers.

As you can imagine, manually managing a product data feed becomes more and more difficult as your product catalog grows. Plus, because the visibility (and eligibility) of your products depends on the quality of your data feed, trying to manage too much information is as risky as it is tedious. That’s why automated feed solutions—software programs like WordStream’s Data Feeds that automatically optimize your product data and sync it with Google Merchant Center—are popular among ecommerce advertisers that sell hundreds or thousands of products.

3. Only 8% of small ecommerce businesses sell on Walmart Marketplace

For reference: 55% sell on their own online stores; 41% sell on a Shopify store; 39% sell on Amazon; 28% sell on eBay; and 13% sell on a BigCommerce store.

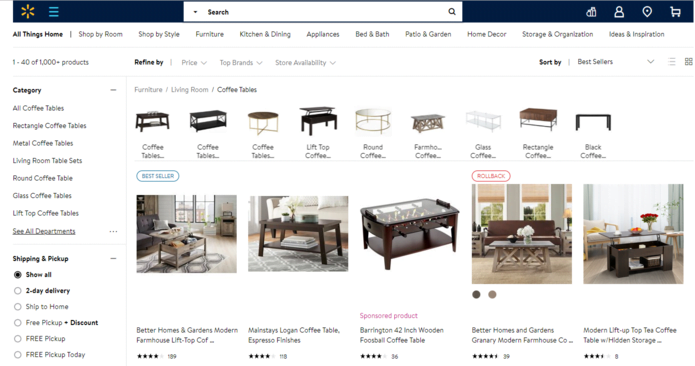

For those of you who haven’t heard of Walmart Marketplace before, it’s a third-party ecommerce platform that enables you to sell your products alongside Walmart’s. It serves to get your catalog in front of the millions of people (mostly Americans) who visit the Walmart website every month. That visibility comes at a cost, of course. Every time you sell a product, Walmart charges a referral fee. Think of the referral fee like a highway toll—you’re paying for access.

Here’s why you should care: The per-sale referral fee is the only cost associated with selling on Walmart Marketplace. It doesn’t matter what you sell or how much of it you sell per month. There’s no monthly subscription cost (as there is on Amazon), and you’ll never get hit with additional fees (as you will on Amazon). Considering we’re talking about the third-largest online retailer in the US, that’s a pretty sweet deal.

To be fair, Amazon boasts several advantages over Walmart Marketplace. In addition to reaching more consumers, Amazon offers a robust pay-per-click advertising platform and a top-notch order fulfillment program. There’s no denying the importance of those tenets.

However, the point is this: Walmart offers a large, affordable marketplace that not too many of your competitors are using. If you have the capacity to add a new platform, be an early adopter!

4. GDN is twice as popular as Bing Shopping among small ecommerce businesses

When we asked our survey participants how they advertise their businesses outside of Google Shopping, 65% listed the Google Display Network—and only 33% listed Bing Shopping.

Let’s be clear about something: We love that a strong majority of ecommerce businesses are using display advertising as an ecommerce tool. to their advantage. As we discuss in our Google display ads cheat sheet, the GDN is a fantastic way to both build your brand and keep it at the top of your prospects’ minds. You can remarket to past website visitors, explicitly target people in the market for your product, and even turn your customer list into seed audiences. Display advertising is a great investment for ecommerce marketing.

But is it twice as valuable an investment as Bing Shopping? Nope. That’s not a shot at the GDN; rather, it’s a vote of confidence for Bing. Allow us to explain.

First things first—although the GDN reaches far more people than Bing Shopping does, the former can’t match the commercial intent of the latter. The people who see your Google display ads aren’t actively looking to buy anything; the people who see your Bing Shopping ads most definitely are. The ability to get your products in front of commercially minded people at the exact moment they’re looking to make a purchase is reason enough to use Bing Shopping.

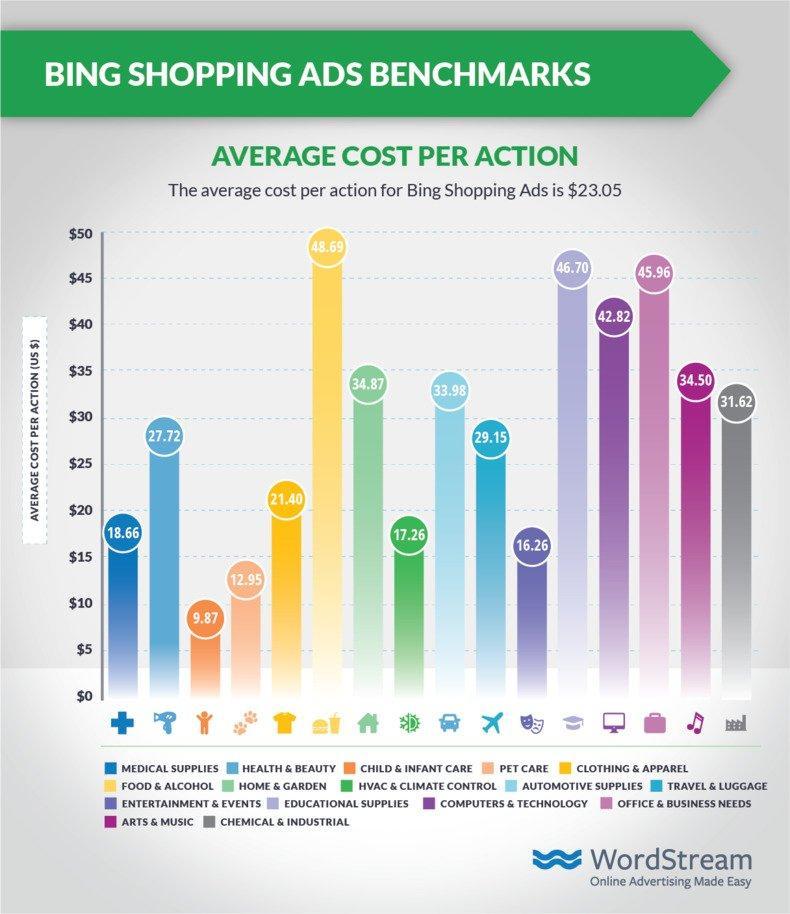

But we’ve got data, too, cowboy. As you can see in our recent report on Google and Bing Shopping benchmarks, Bing offers both cheaper clicks and higher click-through rates. And although Google Shopping users tend to convert at a higher rate, the average Bing Shopping CPA is nearly half the average Google Shopping CPA.

Millions of users. Commercial intent. Cheap clicks and conversions. What else do you want?

5. Only 11% of small ecommerce businesses prioritize expanding to new advertising platforms

One final insight: Whereas 59% of respondents listed improving their campaign ROAS as their top priority—and another 15% listed building out their product catalogs—only 11% listed expanding to new advertising platforms.

Now, this isn’t entirely surprising. At the end of the day, driving more sales at lower costs is the ultimate goal of any ecommerce business. We certainly don’t want to discourage you all from identifying ROAS as a point of focus.

There’s no denying, however, that promoting your products on new platforms—both those that are new to you and those that are new to all digital marketers—comes with a lot of upside.

Let’s focus on platforms that are new to you for now. Winning a new customer is tricky. Even in ecommerce—which has a relatively short sales cycle compared to other industries—advertisers have to be there for a number of key touchpoints if they want a chance of winning someone’s business. Those key touchpoints, of course, are scattered across several platforms and devices. Serving a past website visitor an enticing Instagram carousel ad, for example, is a great way to keep them engaged and start guiding them from the top to the middle of your funnel. And who knows? Maybe that prospect finally ends up converting by way of Bing Shopping.

Via Instagram.

The point is that establishing a cross-platform ecommerce marketing strategy is essential to succeeding as the customer journey becomes more complex and more dispersed.

Let’s wrap up by briefly talking about platforms that are new to all digital marketers. Take Quora, for example—a website that draws hundreds of millions of unique visitors a month and launched an advertising platform (Quora Ads) just a couple years back. According to our recent report on the state of the online advertising landscape, few advertisers are currently running Quora campaigns. Those who are on the platform, therefore, are considered early adopters.

This, too, comes with a lot of upside. By getting there first, you’re able to establish a solid, authoritative presence that automatically gives you an advantage over your competitors. Plus, you’re able to endure valuable learning experiences (read: make painful mistakes) before anyone does. Over the long-run, being early pays dividends.

3 key ecommerce marketing takeaways

Whew! We just covered a fair bit of ground. If you’d like to walk away from this blog post with a couple action items, consider these three ecommerce marketing takeaways:

- Automate your data feed management. Yes—doing so costs money. But it’s a stone that kills two birds: You’ll both free up time for other tasks (like optimizing your Google Shopping campaign structure!) and mitigate the risk of costly product data errors.

- Look into Walmart Marketplace and Bing Shopping. These two marketplaces have several things in common: (1) people go to them to buy stuff; (2) they’re cheaper than the major alternatives; and (3) they’re less competitive. That’s a recipe for success.

- Map your strategy to the customer journey. If you don’t meet your prospects at the key touchpoints that lead up to a purchase, you can’t expect them to make purchases from you. Use social channels to get people into your funnel. Use display to remarket to them and keep your brand top of mind. Use search to close the deal. I’m oversimplifying, of course, but that’s the skeleton of a modern, cross-platform strategy.

A note on the data

To collect the data referenced in this post, we surveyed 75 customers and other businesses with spending budget on Google Shopping. All of the responses came from small and medium-sized businesses. Thanks to Meg Lister for her help with this data set.

0 Comments