jewhyte

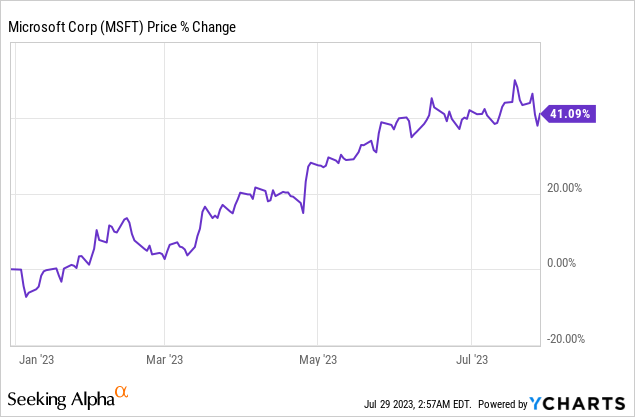

Microsoft (NASDAQ:MSFT) reported results for its fourth fiscal quarter on Wednesday and the firm beat predictions by a good margin, thanks to a strong performance of the Cloud segment as well as easing pain in the Personal Computing business. The latter especially has been under pressure from a serious decline in consumer demand for new PCs and laptops in the last few quarters, but currently experiences relief as fundamentals in the PC market appear to stabilize. I predicted a positive impact on the Personal Computing business before earnings and I believe Microsoft's shares should not have dipped after earnings, especially because Microsoft reported a sequential revenue re-acceleration and very strong free cash flow, with margins exceeding 30%. With fundamentals in the PC market improving, I recommend to buy shares of Microsoft on the dip!

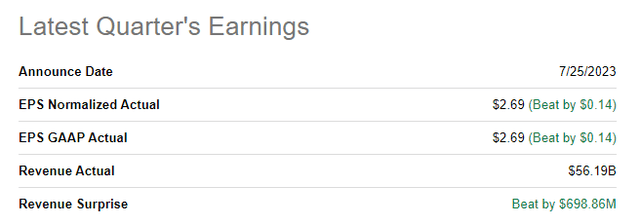

Microsoft beats top and bottom line estimates easily

My prediction was for a strong FQ4 earnings release - Why Microsoft Could Crush FQ4 Earnings - and Microsoft did deliver both a top and bottom line beat: the software company achieved $2.69 per share in adjusted earnings (beating estimates by $0.14 per share) on revenues of $56.19B. Revenues easily sailed past the consensus revenue estimate of $55.49B as well.

Microsoft sees consecutive revenue re-acceleration, PC market appears to stabilize

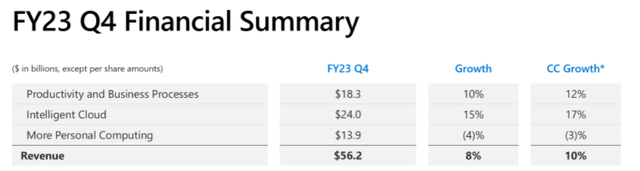

Microsoft generated $56.2B in revenues for FQ4'23, showing 8% year-over-year growth. It was the second consecutive quarter of revenue re-acceleration for Microsoft and this revenue growth was driven by two key factors: (1) Easing pain in the Personal Computing business and (2) Strong growth in Microsoft Cloud segment, which remained the company's growth engine in the last quarter.

As to the first point, the Personal Computing segment.

The Personal Computing business saw a 4% topline decline year over year in Microsoft's FQ4, which is an improvement over the previous quarter. In FQ3'23, Microsoft's revenues dropped 9% Y/Y and in the quarter before that they plummeted a staggering 19% Y/Y. The reason for the sharp drop in segment revenues in the last few quarters was that the segment includes Windows OEM and hardware sales, which were hit hard by the slump in the PC market.

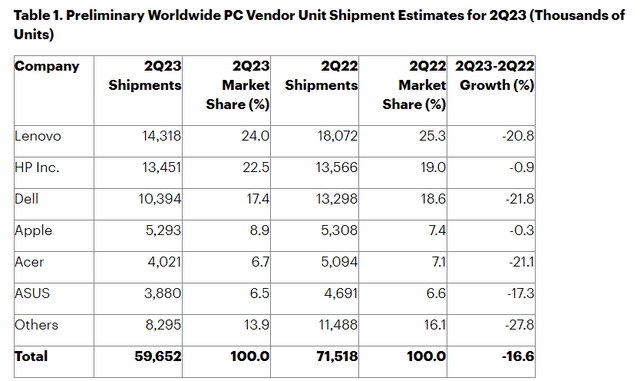

According to research company Gartner, however, conditions in the PC market have improved considerably in the second quarter: global PC shipments declined 16.6 percent in the second quarter compared to a decline of 30.0% in Q1'23 and shipping volumes sequentially increased by 4.5M units. Gartner's PC shipment numbers indicate that the PC market is showing signs of stabilization, which bodes well for Microsoft's Personal Computing business. Also, according to Gartner, "PC inventory will normalize by the end of 2023, and PC demand will return to growth starting in 2024."

This expected recovery in the PC market could set up a powerful tailwind for Microsoft's Personal Computing division, which depends largely on Windows OEM sales to drive revenues.

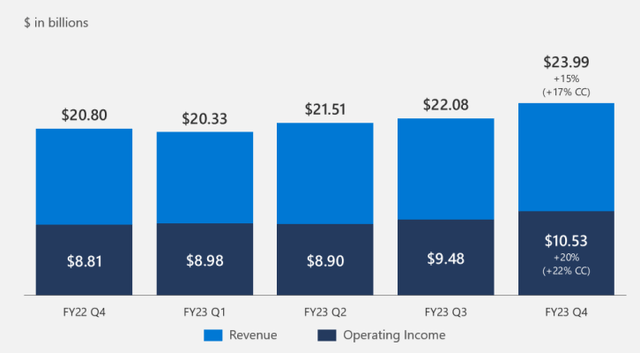

As to the second point, Microsoft's Intelligence Cloud business.

The Cloud segment once again remained the driver of Microsoft's consolidated topline growth, with the business seeing 15% revenue growth year over year. The segment is deeply profitable and generated 20% operating income profit growth in FQ4. In total, Microsoft's Cloud business generated $10.5B in operating income in the last quarter, accounting for 43% of total operating income at Microsoft. While growth slowed slowdown in Cloud, driven by more careful IT spending of corporations, is a bit of a headwind for Microsoft, the segment remained a cash cow for Microsoft in FQ4.

Microsoft continued to post free cash flow margins in excess of 30%

Microsoft's core value lies in its considerable free cash flow that the firm predominantly achieves from the sales of software products. In the fourth fiscal quarter, Microsoft achieved free cash flow of $19.8B, showing 12% year-over-year growth and a free cash flow margin of 35.3%. Microsoft has fairly consistently, with the exception of FQ2'23, posted free cash flow margins in excess of 30% in the last five quarters.

I see Intelligent Cloud growth and a continual recovery in the PC market (positive topline growth in Personal Computing) as potential catalysts for Microsoft to further improve its free cash flow margins in the coming quarters.

$ Billions | FQ4'23 | FQ3'23 | FQ2'23 | FQ1'23 | FQ4'22 | Y/Y Growth |

Revenues | $56,189 | $52,857 | $52,747 | $50,122 | $51,865 | 8% |

Cash Flow From Operating Activities | $28,770 | $24,441 | $11,173 | $23,198 | $24,629 | 17% |

Capital Expenditures | ($8,943) | ($6,607) | ($6,274) | ($6,283) | ($6,871) | 30% |

Free Cash Flow | $19,827 | $17,834 | $4,899 | $16,915 | $17,758 | 12% |

Free Cash Flow Margin | 35.3% | 33.7% | 9.3% | 33.7% | 34.2% | - |

(Source: Author)

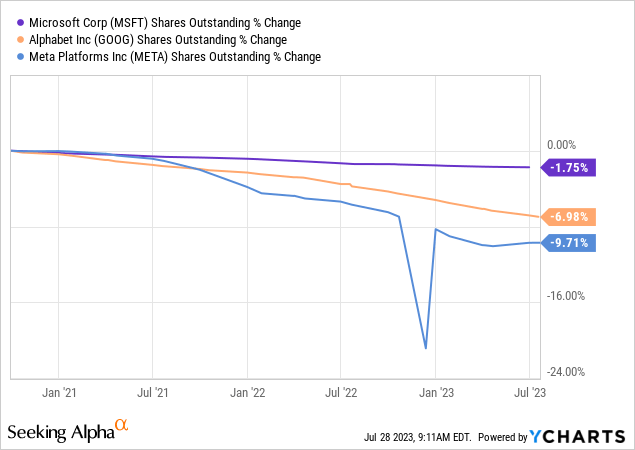

Microsoft has considerable potential to buy back shares, given its enormous free cash flow, but the company is lagging behind other large-cap tech companies in this regard. Microsoft repurchased approximately $5.0B worth of its shares in the second quarter (net of common stock issued) while other companies buy back much more. Alphabet (GOOG) and Meta Platforms (META) repurchased a considerable amount of their shares (between 7-10%) in the last three years, while Microsoft was disappointed.

Outlook for FQ1'24

Microsoft's outlook for FQ1'24 revenues was slightly disappointing as the company guided for $53.8B to $54.8B in revenues. On a midpoint basis, Microsoft's guidance implies 9% Y/Y growth compared to 8% Y/Y in FQ4'23. While Microsoft, therefore, has a chance to see a third consecutive quarter of revenue acceleration, the outlook disappointed as analysts expected FQ1'24 revenue guidance of $54.94B.

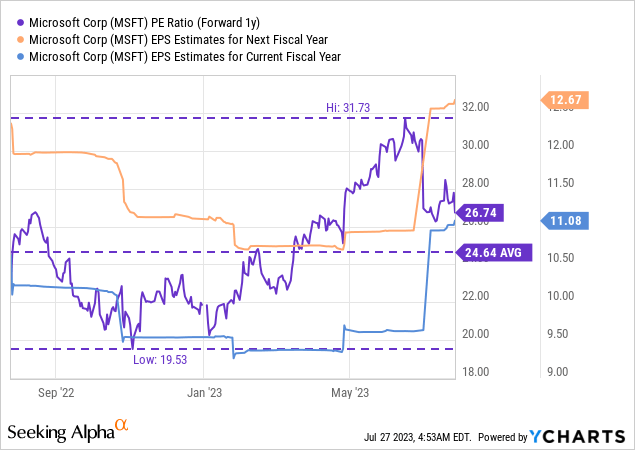

Microsoft's valuation

Although Microsoft's share price dipped after earnings, I believe investors should consider buying the dip as Microsoft is still growing at healthy rates, especially in the Cloud business, and generates an absolutely massive amount of free cash flow that could be used for buybacks or acquisitions. Microsoft's investment into OpenAI, as an example, was a major homerun since the company has started to integrate ChatGPT into its Search results as well as into Azure's OpenAI service.

Assuming a free cash flow margin of 33% and working with a consensus revenue estimate of $235.14B for FY 2024, Microsoft could generate around $77-78B in free cash flow in the next financial year… which calculates to an FCF multiplier factor of 33X.

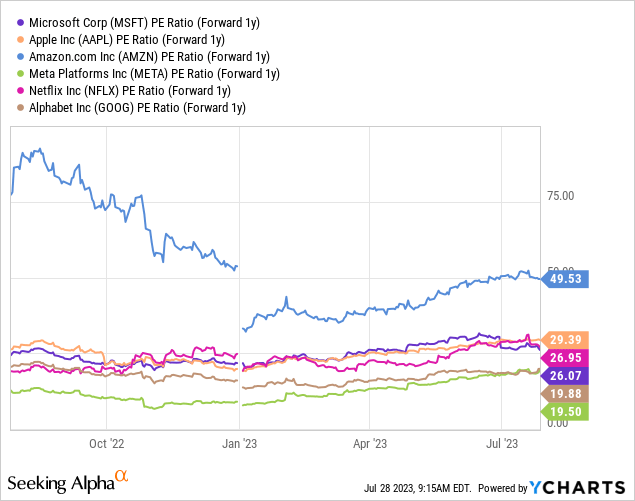

On an earnings basis, shares of Microsoft are valued at 27X FY 2024 earnings, which also isn't cheap. However, Microsoft's enormous free cash flow and ownership of the second-largest Cloud business after Amazon (AMZN)'s AWS justifies the valuation, in my opinion.

Compared against FAANG stocks, Microsoft has a valuation comparable to Netflix (NFLX), a company that is not nearly as profitable as Microsoft. Meta Platforms and Google both are still the cheapest and most promising stocks in this industry group, in my opinion, but are heavily reliant on a recovery in the digital advertising market.

Microsoft's risk profile

A revenue deceleration, especially in the Personal Computing business, would be a negative for Microsoft and its shares and could create a new negative sentiment overhang. There are signs of a PC market stabilization, which reduces revenue headwinds for Microsoft, but the important Cloud segment is seeing a moderate revenue slowdown... which could impact Microsoft's valuation going forward. What would change my mind about Microsoft is if the company saw a decline in its free cash flow (margins).

Closing thoughts

Considering that the Personal Computing business has seen a significant improvement in its trajectory in FQ4'23, I believe Microsoft's shares, while not cheap, have the potential to expand on their 2023 valuation gains. Microsoft delivered healthy double-digit topline growth in Cloud as well as excellent free cash flow margins in excess of 30%, which, in my opinion, help make the bull case for Microsoft despite a high valuation based off of free cash flow and earnings. With fundamentals in the PC market improving, shares of Microsoft are in a buy the dip situation!

0 Comments